Introduction

Generative AI in finance and banking is reshaping the landscape of financial services. As technology evolves, financial institutions are harnessing the power of generative AI to enhance decision-making, improve customer experiences, and streamline operations. This article explores the various applications and benefits of generative AI in finance and banking, highlighting its potential to revolutionize the industry.

Understanding Generative AI

Generative AI refers to algorithms capable of creating new content, whether it be text, images, or data. In finance and banking, this technology is used to analyze vast amounts of data, generate predictive models, and create personalized customer interactions. By leveraging machine learning techniques, generative AI can uncover patterns and insights that are difficult for human analysts to identify.

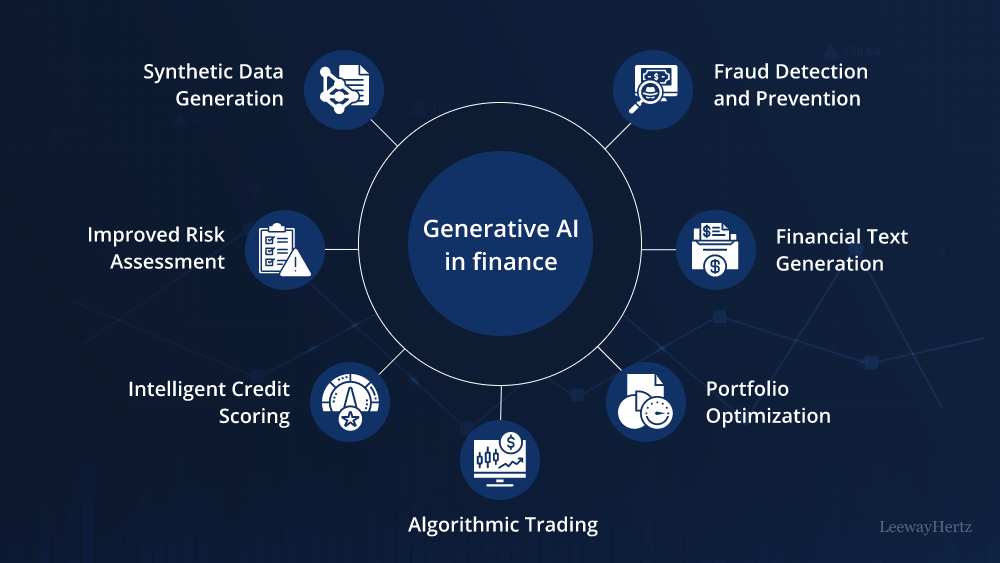

Applications of Generative AI in Finance

Risk Management

One of the most critical applications of generative AI in finance and banking is in risk management. Financial institutions face various risks, including market fluctuations, credit risks, and operational challenges. Generative AI can model potential scenarios, enabling banks to anticipate and mitigate risks effectively. By simulating different market conditions, these models help organizations make informed decisions and develop robust risk management strategies.

Fraud Detection

Fraud is a significant concern for the finance and banking sector. Generative AI can enhance fraud detection systems by identifying unusual patterns in transaction data. By analyzing historical data and generating profiles of normal behavior, these systems can flag suspicious activities in real-time. This proactive approach not only protects financial institutions but also builds trust with customers.

Customer Service Automation

Generative AI in finance and banking also plays a crucial role in enhancing customer service. Chatbots powered by generative AI can handle a wide range of customer inquiries, providing instant responses and personalized recommendations. This technology allows financial institutions to improve customer engagement while reducing operational costs. Additionally, generative AI can analyze customer data to tailor services and products, further enhancing the customer experience.

Financial Forecasting

Accurate financial forecasting is essential for strategic planning in finance and banking. Generative AI algorithms can process large datasets to create predictive models that forecast market trends, asset prices, and economic indicators. These insights enable financial institutions to make data-driven decisions, optimize their investment strategies, and enhance overall performance.

Benefits of Generative AI in Finance and Banking

Increased Efficiency

The implementation of generative AI in finance and banking leads to increased efficiency. By automating routine tasks and processes, financial institutions can allocate resources more effectively. This not only speeds up operations but also allows human employees to focus on more complex tasks that require critical thinking and creativity.

Enhanced Decision-Making

Generative AI provides financial institutions with valuable insights that enhance decision-making processes. By analyzing data from various sources, these models can generate comprehensive reports and visualizations that aid executives in making informed choices. This data-driven approach is crucial in an industry where swift and accurate decisions can significantly impact profitability.

Improved Compliance

Regulatory compliance is a major concern for financial institutions. Generative AI can help automate compliance processes by analyzing transaction data and ensuring that all regulations are met. By identifying anomalies and potential compliance issues, financial institutions can reduce the risk of penalties and enhance their reputation.

Challenges and Considerations

While the benefits of generative AI in finance and banking are substantial, there are also challenges to consider. Data privacy and security are paramount, as financial institutions handle sensitive information. Implementing robust security measures is essential to protect customer data from breaches.

Additionally, the accuracy of generative AI models is critical. Poorly trained models can lead to inaccurate predictions and flawed decision-making. Continuous monitoring and refinement of these models are necessary to maintain their effectiveness.

The Future of Generative AI in Finance and Banking

As generative AI technology continues to evolve, its applications in finance and banking are expected to expand. The integration of generative AI with other emerging technologies, such as blockchain and the Internet of Things (IoT), may unlock new opportunities for innovation.

Moreover, as financial institutions embrace digital transformation, generative AI will play a pivotal role in shaping the future of banking. Organizations that leverage this technology effectively will be better positioned to meet the evolving needs of customers and adapt to the rapidly changing financial landscape.

Conclusion

Generative AI in finance and banking is a powerful tool that holds immense potential for transforming the industry. From risk management to customer service, the applications of this technology are vast and varied. By embracing generative AI, financial institutions can enhance efficiency, improve decision-making, and stay ahead in an increasingly competitive market. As the technology matures, its impact on finance and banking will only grow, paving the way for a more innovative and customer-centric future.

Leave a comment