Introduction: The Rise of Generative AI in Finance and Banking

Generative AI in finance and banking represents a groundbreaking technological advancement that is transforming how financial institutions operate. This technology, driven by machine learning algorithms and neural networks, is increasingly being used to optimize various aspects of the financial sector, from risk management to customer service. In this article, we will explore the current state of generative AI in finance and banking, and discuss its future implications.

The Current State of Generative AI in Finance and Banking

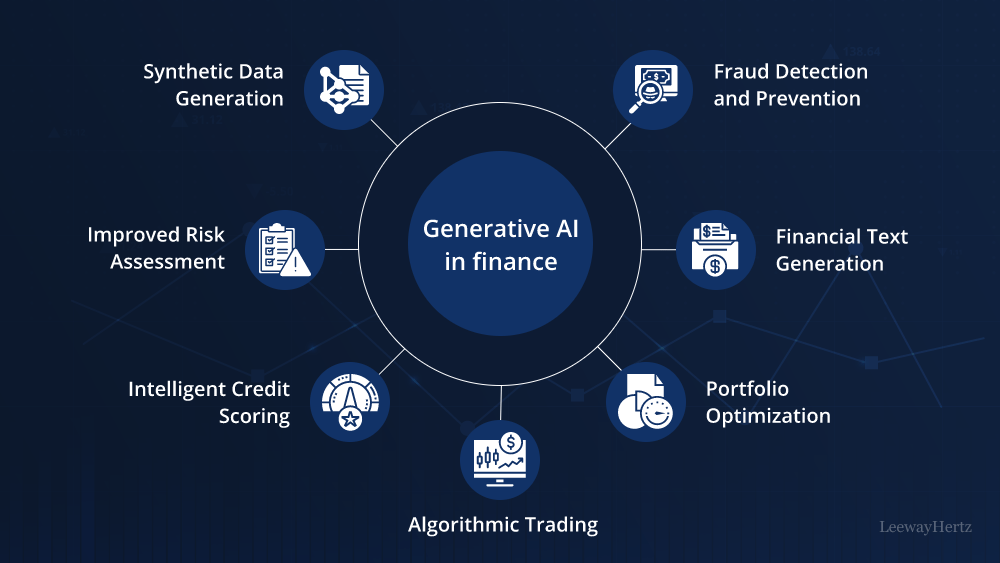

Generative AI refers to artificial intelligence systems that can create new content or data by learning patterns from existing information. In the financial sector, this includes generating financial reports, predicting market trends, and even creating new financial products. Here are some key areas where generative AI is making a significant impact:

- Risk Management and Fraud Detection: Generative AI in finance is enhancing risk management by predicting potential risks and identifying unusual patterns that may indicate fraudulent activities. AI algorithms analyze vast amounts of transaction data to detect anomalies that might go unnoticed by traditional systems. This capability helps in preemptively addressing financial fraud and minimizing risk.

- Customer Service and Personalization: Generative AI in banking is revolutionizing customer service through the use of AI-driven chatbots and virtual assistants. These tools provide personalized recommendations and handle routine inquiries efficiently. By learning from customer interactions, these AI systems improve their responses over time, leading to a more tailored and satisfying customer experience.

- Financial Forecasting and Analysis: Another significant application of generative AI in finance is in the realm of forecasting and analysis. AI models can analyze historical data and generate predictive insights about market trends and financial performance. This ability allows financial analysts and investors to make more informed decisions based on data-driven forecasts.

- Regulatory Compliance: Ensuring compliance with financial regulations is crucial for banks and financial institutions. Generative AI in banking helps automate compliance processes by generating reports and monitoring transactions for regulatory adherence. This reduces the risk of human error and ensures that institutions meet regulatory requirements efficiently.

The Future Implications of Generative AI in Finance and Banking

As generative AI technology continues to evolve, its implications for the finance and banking sectors are profound. Here are some potential future developments:

- Enhanced Decision-Making: In the future, generative AI in finance will further enhance decision-making processes by providing even more accurate and insightful predictions. AI systems will be able to generate complex financial models and simulations that help institutions navigate uncertain economic conditions and market fluctuations with greater confidence.

- Automated Financial Advisory: The future of generative AI in banking may include more sophisticated automated financial advisory services. AI-driven platforms will offer personalized investment strategies and financial planning advice based on individual customer profiles and market analysis, making financial planning more accessible and cost-effective.

- Improved Cybersecurity: As cyber threats become more sophisticated, generative AI will play a crucial role in enhancing cybersecurity measures in the financial sector. AI systems will be able to generate and implement advanced security protocols to protect sensitive financial data and prevent unauthorized access.

- Innovative Financial Products: Generative AI in finance is likely to drive the creation of innovative financial products and services. By analyzing market trends and customer preferences, AI can help design new investment products, loan structures, and insurance policies that better meet the needs of consumers.

- Ethical and Regulatory Considerations: As generative AI becomes more prevalent in finance and banking, ethical and regulatory considerations will become increasingly important. Ensuring transparency, fairness, and accountability in AI systems will be crucial to maintaining trust and compliance in the financial industry.

Challenges and Considerations

While the benefits of generative AI in finance and banking are significant, there are also challenges that need to be addressed. These include:

- Data Privacy and Security: With the increased use of AI, protecting sensitive financial data from breaches and misuse is critical. Financial institutions must implement robust data security measures to safeguard against potential threats.

- Bias and Fairness: AI systems can inadvertently perpetuate biases present in historical data. Ensuring that generative AI algorithms are designed to be fair and unbiased is essential for maintaining equity in financial services.

- Regulatory Compliance: The rapid advancement of AI technology poses challenges for regulatory frameworks. Financial institutions need to stay updated with evolving regulations to ensure their AI systems comply with legal requirements.

Conclusion

Generative AI in finance and banking is transforming the industry by enhancing risk management, improving customer service, and driving innovation. As this technology continues to evolve, its future implications will shape the financial landscape, leading to more informed decision-making, automated advisory services, and innovative financial products. However, addressing challenges related to data privacy, bias, and regulatory compliance will be crucial for the successful integration of generative AI in the financial sector. Embracing these advancements while navigating the associated challenges will be key to unlocking the full potential of generative AI in finance and banking.

Leave a comment