Introduction

In an era where financial markets are growing increasingly complex, regulatory compliance has become a critical aspect for financial institutions. Maintaining compliance with evolving regulations can be challenging and resource-intensive. However, the advent of Artificial Intelligence (AI) is revolutionizing the compliance landscape. This article explores how AI for financial compliance is transforming the industry, ensuring adherence to regulations while enhancing operational efficiency.

The Importance of Financial Compliance

Financial compliance refers to the adherence to laws, regulations, and guidelines that govern the financial sector. It is essential to maintain market integrity, protect consumers, and prevent financial crimes such as money laundering and fraud. Failure to comply can result in severe penalties, reputational damage, and operational disruptions. Traditionally, compliance processes have been manual and time-consuming, requiring significant human resources.

The Rise of AI in Financial Compliance

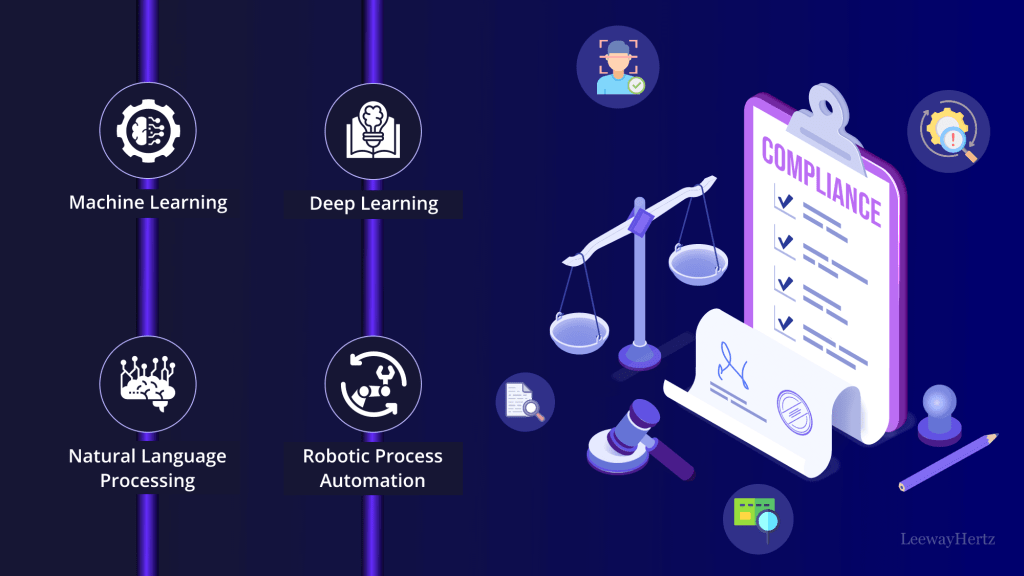

AI, with its capabilities of machine learning, natural language processing, and data analytics, is being increasingly adopted to streamline compliance processes. AI for financial compliance offers numerous benefits, including enhanced accuracy, reduced costs, and the ability to process large volumes of data efficiently.

Key Applications of AI in Financial Compliance

- Automated Monitoring and Reporting

AI systems can automatically monitor transactions and activities, flagging any suspicious behavior for further investigation. This continuous surveillance ensures real-time detection of potential non-compliance issues, reducing the risk of financial crimes. - Regulatory Reporting

Keeping up with the changing regulatory requirements is a significant challenge. AI can help by automating the generation of regulatory reports, ensuring they are accurate and submitted on time. This not only reduces the burden on compliance teams but also minimizes the risk of errors. - KYC and AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations require financial institutions to verify the identity of their clients and monitor their transactions. AI for financial compliance can enhance KYC and AML processes by automating identity verification, transaction monitoring, and risk assessment, thus improving efficiency and accuracy. - Fraud Detection

AI can analyze vast amounts of data to identify patterns and anomalies indicative of fraudulent activities. By continuously learning from new data, AI systems can adapt and improve their fraud detection capabilities, providing a robust defense against financial fraud. - Risk Management

AI can assess and predict compliance risks by analyzing historical data and identifying trends. This proactive approach enables financial institutions to take preventive measures, mitigating potential risks before they escalate into significant issues.

Benefits of AI for Financial Compliance

1. Increased Efficiency and Cost Savings

Automating compliance processes with AI significantly reduces the time and resources required, leading to cost savings. Compliance teams can focus on more strategic tasks rather than routine monitoring and reporting.

2. Enhanced Accuracy and Reliability

AI systems can process vast amounts of data with high precision, minimizing the risk of human error. This ensures that compliance reports and monitoring activities are accurate and reliable.

3. Real-time Monitoring

Continuous, real-time monitoring of transactions and activities allows for immediate detection and response to potential compliance issues. This proactive approach is crucial in preventing financial crimes and ensuring adherence to regulations.

4. Scalability

AI solutions can easily scale to handle growing data volumes and complex regulatory requirements. This scalability ensures that financial institutions can maintain compliance as they expand their operations.

5. Improved Risk Management

By identifying and predicting compliance risks, AI enables financial institutions to take a proactive approach to risk management. This reduces the likelihood of regulatory breaches and associated penalties.

Challenges and Considerations

While AI offers significant advantages, its adoption in financial compliance also presents challenges. These include data privacy concerns, the need for robust data governance frameworks, and the requirement for ongoing monitoring and updating of AI systems to ensure they remain effective. Additionally, integrating AI with existing systems and processes can be complex and may require substantial investments.

Conclusion

AI for financial compliance is transforming the way financial institutions approach regulatory adherence. By automating monitoring, reporting, and risk management processes, AI enhances efficiency, accuracy, and reliability. While challenges exist, the benefits of AI far outweigh the potential drawbacks, making it an essential tool for modern financial compliance. As the regulatory landscape continues to evolve, AI will play a pivotal role in ensuring that financial institutions remain compliant, secure, and resilient.

Future Outlook

The future of AI for financial compliance looks promising. As AI technologies continue to advance, their applications in compliance will expand, offering even greater capabilities for managing regulatory requirements. Financial institutions that embrace AI will be better positioned to navigate the complexities of compliance, ultimately achieving greater operational efficiency and regulatory adherence.

By leveraging AI for financial compliance, financial institutions can not only meet regulatory requirements but also gain a competitive edge in the rapidly evolving financial landscape.

Leave a comment