Introduction

In the fast-evolving landscape of finance, technology continues to redefine traditional practices. One such innovation making significant waves is Generative AI in asset management. This groundbreaking application of artificial intelligence (AI) is transforming how investment professionals analyze data, predict market trends, and optimize portfolios.

Understanding Generative AI

Generative AI refers to a class of AI algorithms that learn to mimic patterns and generate new content similar to the data they were trained on. Unlike traditional statistical models, which rely on historical data patterns, generative models can create entirely new datasets based on learned patterns. This capability opens up unprecedented possibilities in asset management.

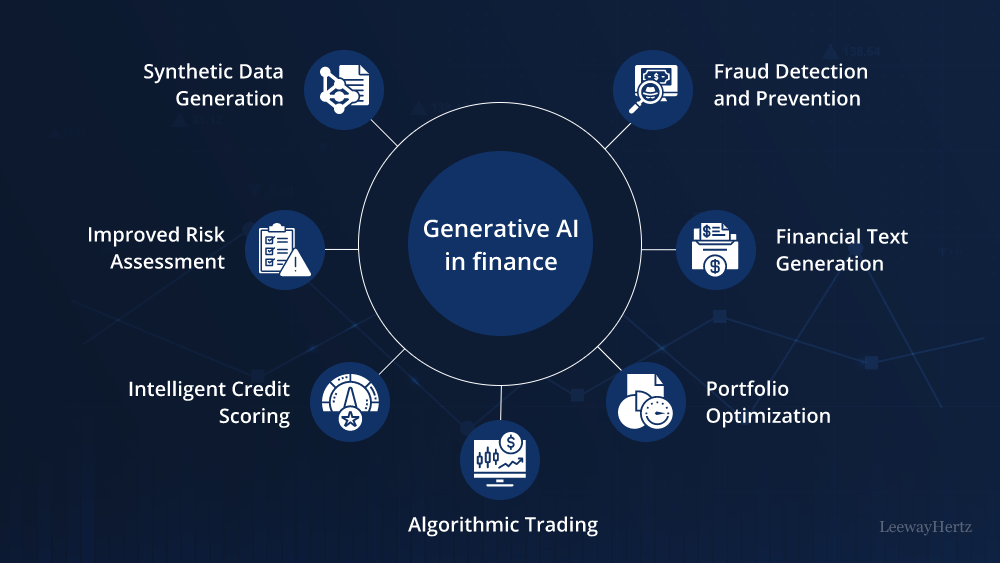

Applications in Asset Management

Generative AI finds application across various facets of asset management, enhancing decision-making processes and risk management strategies.

1. Portfolio Optimization

Traditionally, portfolio optimization relied on historical data and statistical models to balance risk and return. Generative AI introduces a dynamic approach by generating synthetic data that mimics real-world scenarios. This allows asset managers to stress-test portfolios against a wider range of potential market conditions, thereby improving resilience and performance prediction.

2. Risk Management

Risk management is critical in asset management to mitigate potential losses. Generative AI models can simulate various risk scenarios by generating synthetic data sets that reflect different economic conditions, market volatilities, and geopolitical events. This proactive approach enables more robust risk assessment and strategic planning.

3. Predictive Analytics

Predicting market trends and asset price movements is a cornerstone of successful asset management. Generative AI enhances predictive analytics by identifying complex patterns in data that human analysts may overlook. By generating alternative scenarios and outcomes, these models provide deeper insights into potential market shifts, helping investors make more informed decisions.

Challenges and Considerations

While Generative AI presents compelling advantages, its adoption in asset management comes with challenges and considerations.

1. Data Quality and Bias

Generative AI models heavily rely on the quality and diversity of training data. Biased or incomplete data sets can lead to inaccurate simulations and predictions, impacting investment decisions.

2. Regulatory Compliance

The financial industry is highly regulated, and integrating AI technologies like Generative AI requires adherence to strict compliance standards. Ensuring transparency, fairness, and accountability in AI-driven decisions is crucial to regulatory compliance.

Future Outlook

The future of Generative AI in asset management looks promising, with ongoing advancements and innovations reshaping the industry.

1. Enhanced Decision-Making

As Generative AI continues to evolve, it will empower asset managers with more sophisticated decision-making tools. By generating nuanced insights and predictive analytics, these models will help anticipate market dynamics and optimize investment strategies.

2. Ethical Considerations

Ethical considerations surrounding AI, such as data privacy, algorithmic transparency, and the responsible use of AI-generated insights, will become increasingly important. Addressing these concerns will be pivotal in fostering trust and acceptance of Generative AI in asset management.

Conclusion

Generative AI represents a transformative force in asset management, offering unprecedented capabilities in portfolio optimization, risk management, and predictive analytics. While challenges exist, the potential benefits of integrating Generative AI are substantial, promising to elevate investment strategies and redefine industry standards. As financial institutions continue to harness the power of AI-driven innovation, the future of asset management looks increasingly intelligent and adaptive.

Leave a comment