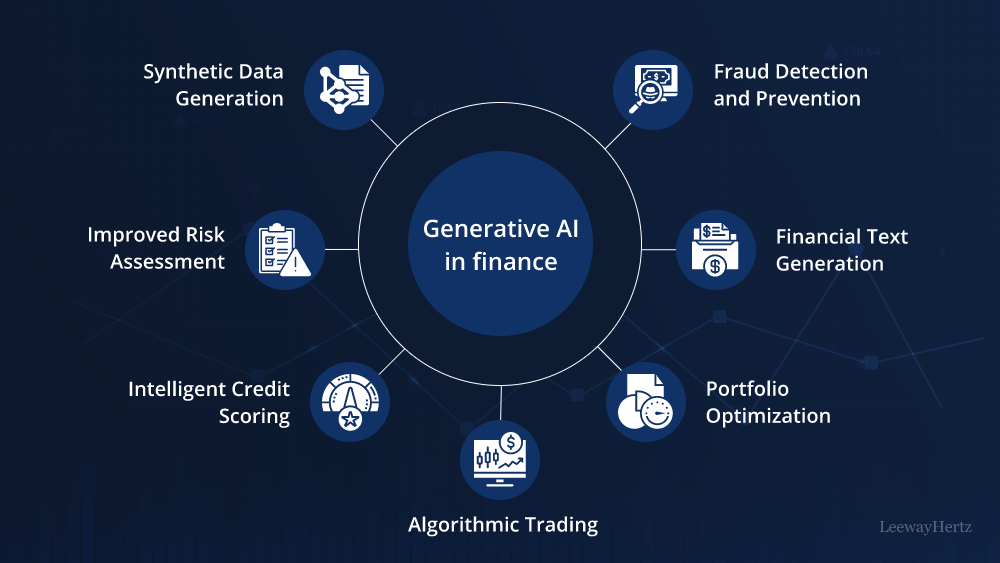

The financial sector has always been at the forefront of technological innovation, constantly seeking tools that can enhance efficiency and profitability. One such revolutionary technology is Generative AI. In asset management, Generative AI is reshaping the landscape by offering advanced analytical capabilities and creating new opportunities for data-driven decision-making. This article delves into the transformative impact of Generative AI in asset management, exploring its benefits, applications, and future prospects.

Understanding Generative AI

Generative AI refers to a subset of artificial intelligence that uses machine learning models to generate new data from existing datasets. Unlike traditional AI, which focuses on classification and prediction, Generative AI can create new content that mimics the characteristics of the input data. This capability is powered by models like Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs), which learn from large datasets to produce realistic simulations and predictions.

Enhancing Predictive Analytics

One of the most significant applications of Generative AI in asset management is enhancing predictive analytics. Traditional predictive models rely on historical data and predefined algorithms, which can sometimes fail to capture the complexities of financial markets. Generative AI, however, can simulate a wide range of market conditions and scenarios, providing asset managers with deeper insights and more robust predictions.

For example, Generative AI can create synthetic data that reflects potential future market trends. This synthetic data can be used to train predictive models, improving their accuracy and reliability. By simulating different market conditions, Generative AI helps asset managers test various investment strategies and assess their potential outcomes before implementing them in the real world.

Portfolio Optimization

Portfolio optimization is another area where Generative AI is making a substantial impact. Traditional portfolio optimization techniques often struggle with the vast amount of data and the dynamic nature of financial markets. Generative AI can process and analyze large datasets more efficiently, identifying patterns and correlations that might be missed by conventional methods.

Generative AI can generate numerous possible portfolio configurations based on different risk-return profiles. Asset managers can then evaluate these configurations to select the optimal portfolio that aligns with their investment goals and risk tolerance. This approach not only enhances decision-making but also helps in diversifying investments and mitigating risks.

Risk Management

Effective risk management is crucial in asset management, and Generative AI offers powerful tools to enhance this process. By generating synthetic datasets and simulating various market conditions, Generative AI enables asset managers to identify potential risks and vulnerabilities in their portfolios.

For instance, Generative AI can model extreme market events, such as financial crises or sudden market shocks, and assess their impact on different assets. This allows asset managers to develop contingency plans and implement strategies to safeguard their investments. Additionally, Generative AI can help in stress testing, ensuring that portfolios remain resilient under adverse conditions.

Personalized Investment Strategies

Generative AI also enables the creation of personalized investment strategies tailored to individual investor preferences. By analyzing vast amounts of data on investor behavior and market trends, Generative AI can generate customized investment recommendations that align with the specific goals and risk profiles of investors.

This level of personalization enhances the client experience and fosters greater trust between asset managers and their clients. Investors receive strategies that are not only data-driven but also closely aligned with their unique financial objectives, leading to better investment outcomes and higher satisfaction levels.

Enhancing Operational Efficiency

Beyond investment strategies, Generative AI can significantly enhance operational efficiency in asset management. Routine tasks such as data entry, report generation, and compliance checks can be automated using AI-generated solutions. This automation reduces the workload on human analysts, allowing them to focus on more strategic activities.

Moreover, Generative AI can streamline data management by generating synthetic datasets that fill gaps in historical data. This ensures that asset managers have access to comprehensive and high-quality data, further enhancing their analytical capabilities and decision-making processes.

Future Prospects and Challenges

The future of Generative AI in asset management looks promising, with ongoing advancements in AI technologies and increasing adoption within the financial sector. However, there are challenges to consider. Ensuring data privacy and security is paramount, as the use of synthetic data and AI models involves handling sensitive financial information. Additionally, there is a need for continuous monitoring and validation of AI-generated outputs to maintain accuracy and reliability.

Despite these challenges, the potential benefits of Generative AI in asset management are immense. As technology continues to evolve, asset managers will have access to more sophisticated tools that enable them to navigate complex financial markets with greater confidence and precision.

Conclusion

Generative AI is revolutionizing asset management by enhancing predictive analytics, optimizing portfolios, improving risk management, personalizing investment strategies, and boosting operational efficiency. As the financial sector continues to embrace this cutting-edge technology, asset managers are poised to achieve unprecedented levels of performance and client satisfaction. The integration of Generative AI in asset management not only represents a technological advancement but also marks a significant step towards a more data-driven and resilient financial future.

Leave a comment