In the intricate world of finance, where adhering to regulations is an absolute necessity, AI in financial compliance has emerged as a transformative catalyst, revolutionizing the way institutions navigate the complex maze of rules and guidelines. The burden of financial regulatory compliance is immense, with organizations grappling with an intricate web of interconnected laws, standards, and obligations. Failure to comply can have severe ramifications, including hefty fines, reputational damage, and even the revocation of operating licenses.

The Limitations of Traditional Compliance Approaches

Historically, financial institutions have relied on manual processes and human oversight to ensure regulatory compliance. However, these traditional approaches are often overwhelmed by the sheer volume of data and the ever-changing regulatory landscape. Human error, limited processing capabilities, and the inability to detect intricate patterns in vast datasets pose significant challenges, leaving institutions vulnerable to compliance risks.

AI in Financial Compliance: The Transformative Solution

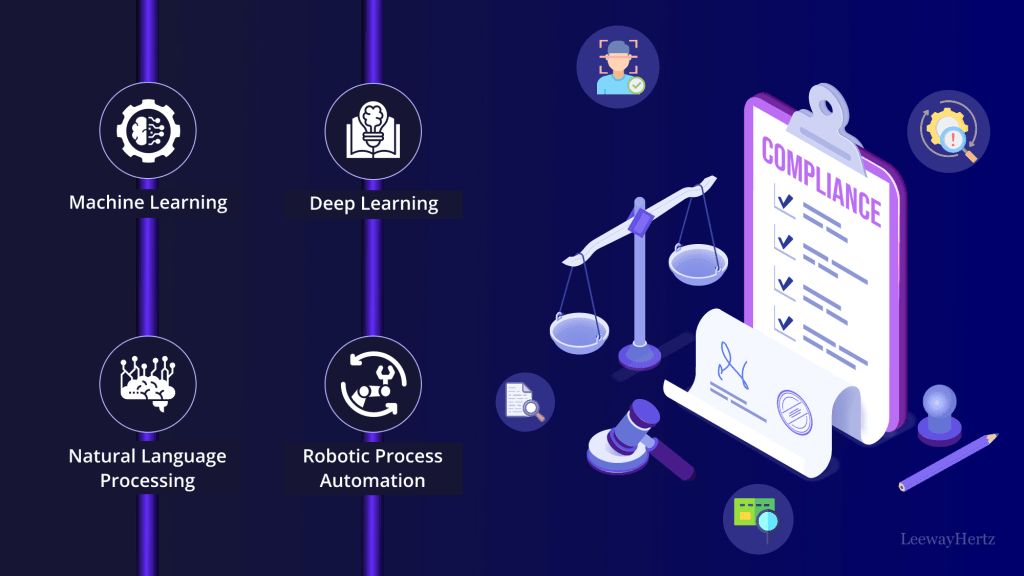

AI in financial compliance offers a transformative solution, revolutionizing the way institutions approach regulatory adherence. Advanced technologies, such as machine learning, natural language processing (NLP), and robotic process automation (RPA), are reshaping financial compliance processes, enabling institutions to streamline operations, enhance accuracy, and adapt swiftly to evolving regulatory requirements.

- Automated Transaction Monitoring

- KYC Verification and Onboarding

- Regulatory Text Analysis

- Robotic Process Automation (RPA)

The Advantages of Embracing AI in Financial Compliance

Integrating AI in financial compliance offers numerous advantages to financial institutions, including increased accuracy and precision, enhanced efficiency and automation, real-time compliance updates, and an improved customer experience.

The Future of AI in Financial Compliance

As AI technologies continue to evolve, the role of AI in financial compliance is poised to become even more pivotal. Emerging trends, such as explainable AI (XAI), regulatory technology (RegTech) ecosystems, and predictive compliance analytics, will further enhance the capabilities of financial institutions to navigate the complexities of regulatory compliance.

Conclusion

In the ever-evolving landscape of finance, where regulatory adherence is a critical imperative, AI in financial compliance has emerged as a transformative catalyst, empowering institutions to navigate the complex maze of rules and guidelines with unparalleled efficiency and accuracy. By harnessing the power of advanced technologies, financial institutions can streamline processes, enhance accuracy, and adapt swiftly to evolving regulatory requirements, ensuring they remain compliant while minimizing risks and optimizing operational efficiency.

Leave a comment